Sale Leaseback

Have you ever thought about the “sale and leaseback” of your real estate in the short or long term? Due to the scarcity in the real estate market, there is a growing group of investors looking for commercial real estate investments. Is your real estate still your ownership? It probably was a deliberate choice at the time but perhaps worth reconsidering at the moment.

Benefits sale and leaseback

Our experience shows that entrepreneurs are attracted to the sale and leaseback of real estate for personal or business reasons. In this way, it offers the opportunity to:

- Invest the revenue from sales in (the core business of) a company;

- Prevent or circumvent a credit application to a bank;

- Accelerate the sale of a business;

- Create an extra pension provision for the entrepreneur/owner;

- To strengthen and shorten the balance sheet of an enterprise;

- Realise a higher return on sales, because immediately renting back a business property often leads to a higher return.

Of course, as an entrepreneur, you should realise that you enter into a monthly rental obligation and that you will have less say in commercial real estate. The latter, however, can be partly overcome contractually by including a first right of purchase.

Sale and leaseback expert

VANDERSTELT specialises in sales and leaseback issues that meet the following characteristics:

Investment volume

From € 3 million per property (no maximum per property/portfolio).

Property

Light industrial, industrial buildings, logistics, care and objects for a specific use.

Seller / Renter

Financially sound/stable in a future-proof sector/industry.

Rental contract

Off 10 year.

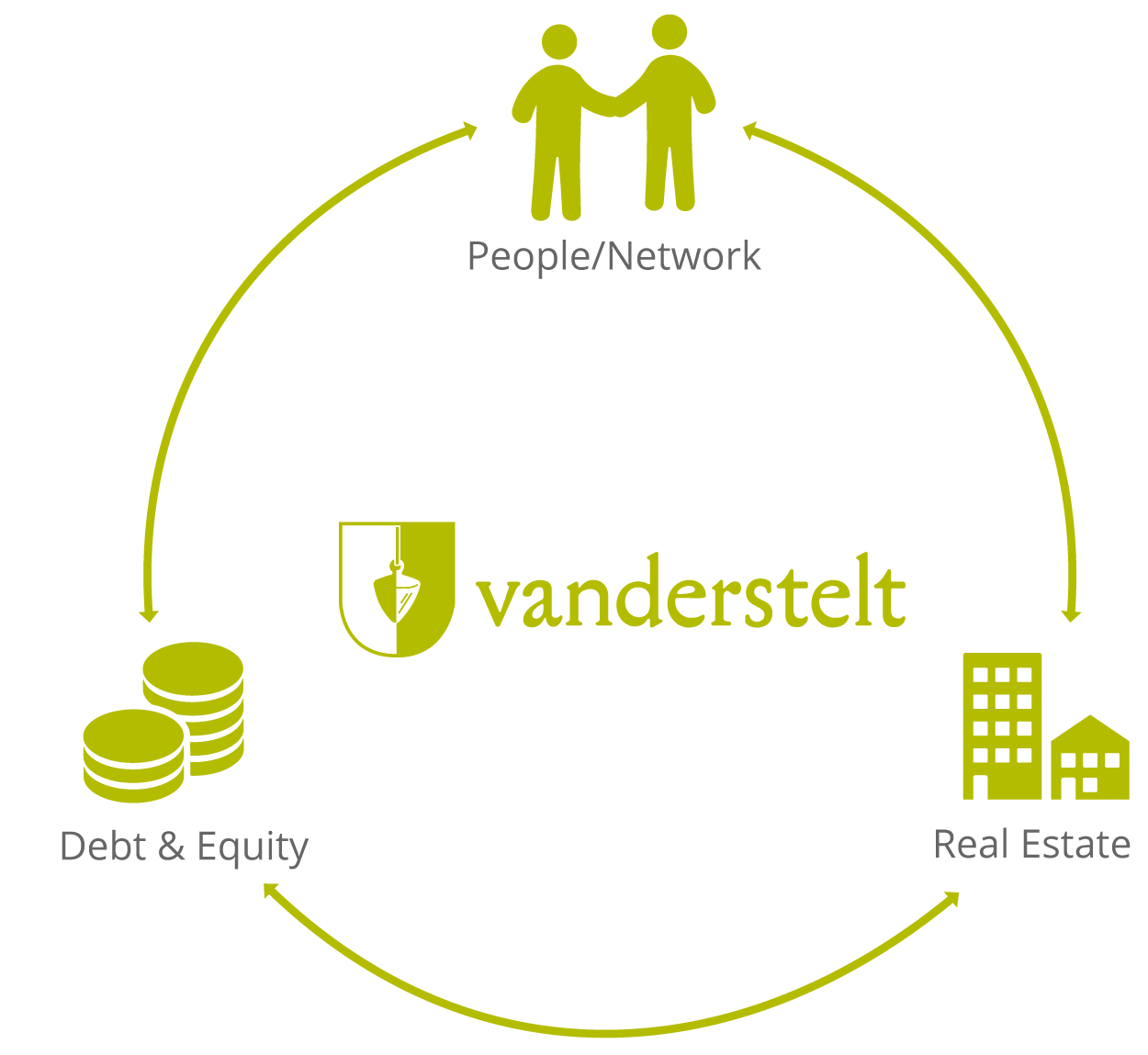

The unique combination of knowledge, expertise, experience, market information and network make the difference.

If you enter “sale leaseback” as a keyword in Google you will find a lot of sites that can explain the advantages and disadvantages of this construction. In short, there is plenty to find online about how it works in theory. However, few parties are able to make the connection with buyers/investors. That is precisely the added value of VANDERSTELT.

Besides theory you will need to get in contact with a partner who can guide you through the practical implementation:

- Is a sale and leaseback the answer to your needs?

- Is your real estate suitable for leaseback?

- Which rent or sale price is real and under which timeframe/conditions?

- Which type of investor/buyer suits your real estate and your long-term housing needs?

This is the basis of an Investment Memorandum to be made, which we will, in consultation with you, very specifically offer to the most calibrated investors with an investment profile that meets your needs.

A concept for more than 5 years

Free quick scan and step-by-step plan by VANDERSTELT

VANDERSTELT is an expert in the field of tailor-made sales and leaseback transactions and also specialises in ‘off market’ investment transactions. The transactions we carry out are therefore not published. Our clients often do not want to create unnecessary turmoil among staff or disclose competitively sensitive information. For many years we have been extremely focused and precise in approaching the most calibrated investors for commercial real estate that meet the short and long term wishes of you as the owner. Our approach is thorough, personal, discreet and unburdening. And not unimportantly: we work on a no cure no pay basis.

We would like to offer you the opportunity to have a look together at whether the sale and leaseback of your real estate can also meet your personal or business needs. If there are any leads for you to get to know us at your office, please let us know.

“As an independent party VANDERSTELT follows the current real estate market closely and knows like no other who the active players are in the market in which you operate”.